- Phone: (031) 849 5566

- WA: +6282140060234

- Email: [email protected]

- Hours: Mon-Fri, 8am - 5pm

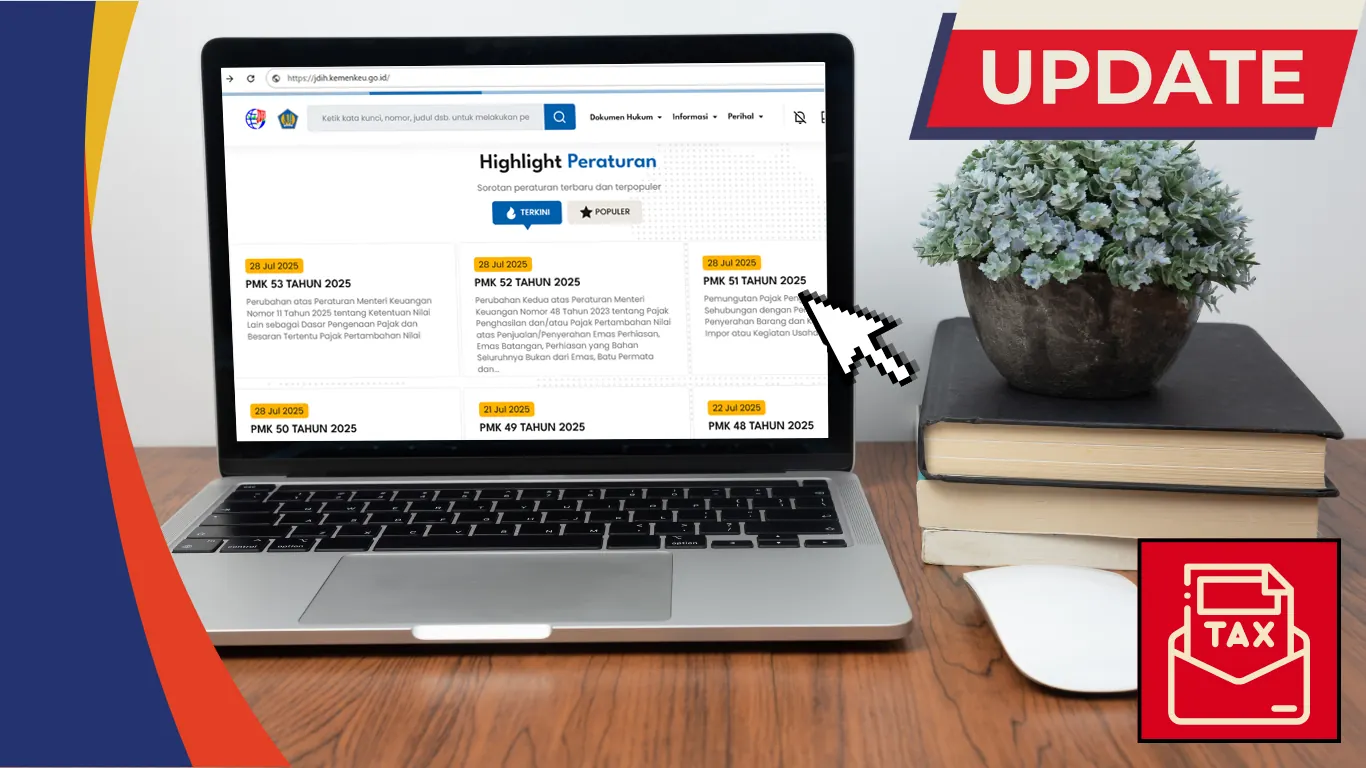

4 Major Tax Changes Coming August 2025 Under PMK 50–53/2025

Four new tax regulations have officially been enacted and will take effect on August 1, 2025. These four Ministry of Finance Regulations (PMK)—Numbers. 50, 51, 52, and 53 of 2025—introduce significant adjustments to Indonesia’s tax system. The changes affect cryptocurrency assets, import activities, gold & jewelry trade, and VAT calculation basis.

Summary of PMK 50/2025 to PMK 53/2025

To provide a clear overview of each regulation’s scope and impact, the following summarizes the key changes in PMK 50 through PMK 53 of 2025:

| PMK | Topic | Impact |

|---|---|---|

| 50/2025 | Tax on crypto assets and services | Crypto transactions exempt from VAT; services like mining and exchange subject to 2.2% effective VAT. |

| 51/2025 | Withholding Tax on Imports | New rates and collector list introduced, including on gold bullion transactions. |

| 52/2025 | Tax on Gold & Gemstones | Final buyers and entities like BI & bullion firms exempt from Income Tax Article 22. |

| 53/2025 | VAT Calculation Basis | “Other value” removed; VAT now based on actual sale price. |

Details of the New PMK Regulations

To begin with, PMK 50/2025 changes how crypto assets are taxed. Starting August 1, 2025, crypto transactions are no longer subject to VAT since they are treated like securities. However, supporting services such as transaction verification, digital wallets, and exchanges are still taxed at an effective 2.2% VAT. This aims to create a fair tax system without stifling blockchain innovation.

Meanwhile, PMK 51/2025 introduces new rates and structures for Withholding Tax Article 22 on imports and certain sectors. Rates vary from 0.25% to 1.5%, based on the type of goods. The regulation also broadens the tax base while providing relief for MSMEs.

On the other hand, PMK 52/2025 provides relief for end consumers of gold and gemstones. The 0.45% tax on end buyers is eliminated. Now, taxation applies only within the distribution chain. This aims to prevent double taxation and preserve consumer purchasing power.

Finally, PMK 53/2025 simplifies VAT calculation. The “other value” basis is removed. Reporting must now reflect the actual transaction value, with VAT remaining at 11%. This step improves reporting accuracy and reduces tax manipulation.

Implications for Taxpayers

- Crypto businesses: Must update accounting systems. Services like transaction verification, wallets, and exchanges are now VAT-taxable.

- Importers & certain businesses: Must understand the new 0.25%–1.5% income tax article 22 rates and ensure transactions go through official collectors.

- Gold & jewelry traders: Customer classification is key. Tax now applies only along the distribution chain—not on final consumers.

- General taxpayers: Must revise VAT reporting and payments. With the removal of “other value,” calculations must be based on real transaction values under PMK 53/2025.

Read Also: [KJA] Reliable Partner for Financial Statements and Tax Compliance

Consult Your Tax Concerns

With the implementation of PMK 50–53/2025, the government reinforces its commitment to a fair, modern, and adaptive tax system. Businesses—from crypto to gold trade—must adjust promptly to avoid penalties or miss out on incentives.

The best first step is to understand these regulatory changes, assess your internal systems, and consult with professionals. PT Synergy Ultima Nobilus (SUN) is ready to support your transition with tailored, compliant strategies. Contact us today to schedule a consultation.