- Phone: (031) 849 5566

- WA: +6282140060234

- Email: [email protected]

- Hours: Mon-Fri, 8am - 5pm

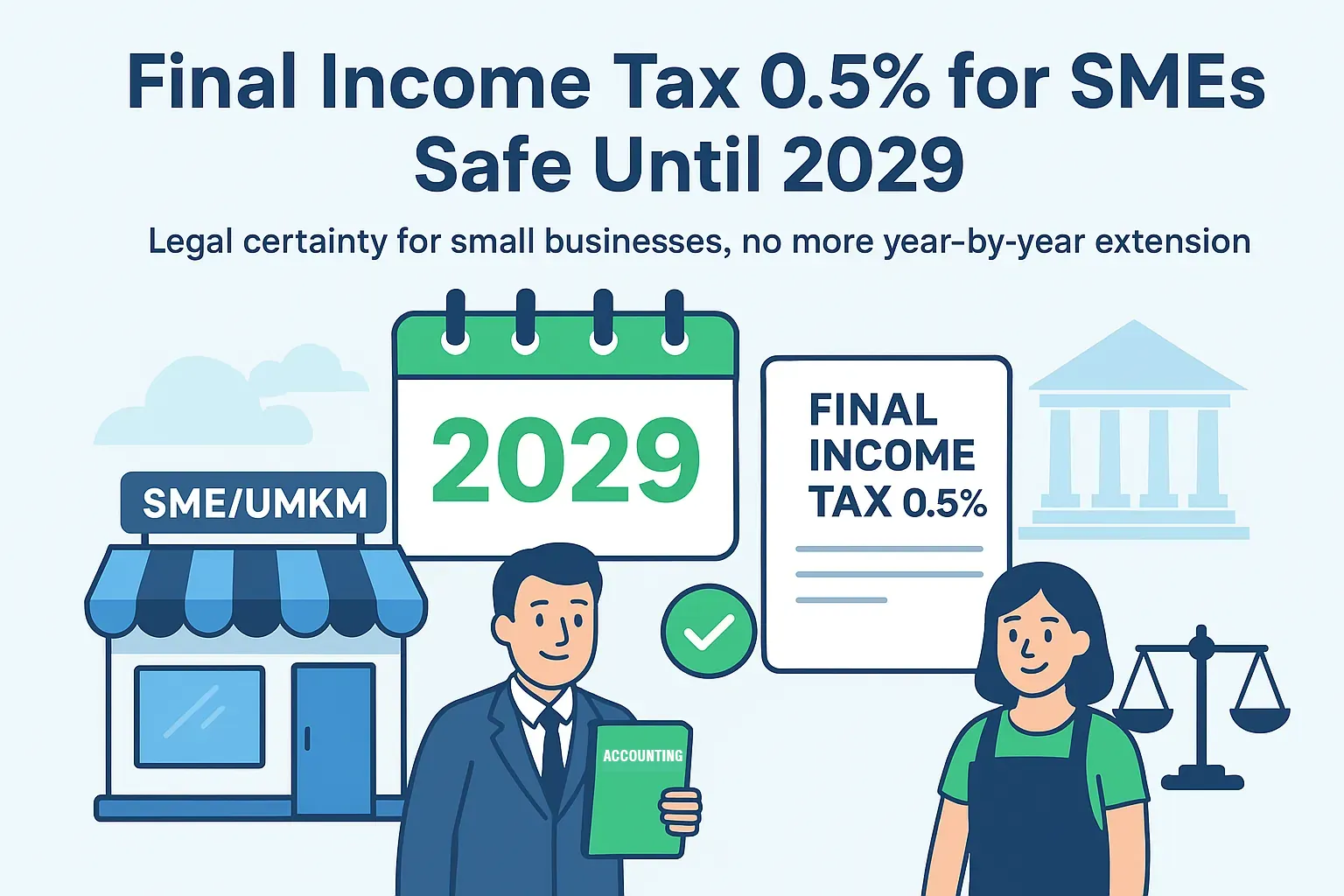

Safe Until 2029: Individual MSMEs Get Relief, Firms Still Waiting

Government Extends Relief for Individual MSMEs Taxpayers: Final Income Tax 0.5% Until 2029, But What About Corporate Entities?

The government has announced good news for micro, small, and medium enterprise (MSME) taxpayers who are individuals: the 0.5% Final Income Tax on turnover will be extended until 2029. This decision provides relief for millions of sole proprietors who were concerned about moving to the general tax scheme starting in 2025. However, this announcement also raises a critical question: what will happen to MSMEs in the form of partnerships (CV), cooperatives, firms, and limited liability companies (PT)?

A Brief History: From PP 23/2018 to PP 55/2022

The 0.5% Final Income Tax scheme for MSMEs was first introduced under Government Regulation (PP), specifically PP 23/2018. Its purpose was clear: to ease the administrative burden on MSMEs with annual turnover up to IDR 4.8 billion. The final tax of 0.5% was levied directly on turnover, without requiring calculation of net income.

From the outset, however, this scheme was temporary, depending on the taxpayer’s legal form:

- Individuals: 7 years

- Non-PT entities (CV, firms, cooperatives, BUMDes): 4 years

- PT (limited liability companies): 3 years

Later, this regulation was revised by PP 55/2022. This updated regulation reaffirmed the limited duration of the scheme, added an exemption for the first IDR 500 million turnover for individuals, and introduced an annual requirement for taxpayers to obtain a certificate in order to continue using this facility.

A “Time Bomb” for the Final Tax Facility

PP 55/2022 emphasized that the 0.5% rate was only temporary. The facility was not permanent and had to be reapplied for each year. For individual MSMEs that began using the scheme in 2018, the 7-year term for individuals ended in 2024. Meanwhile, CVs, cooperatives, and PTs had even shorter periods—most of which also expired by the 2025 tax year. Without an extension, they would have to revert to the general corporate income tax rate of 22%, with only limited relief in the form of a 50% reduction on turnover up to IDR 4.8 billion (if annual turnover does not exceed IDR 50 billion).

Also Read: MSME Tax: 7 Rules Every Business Owner Must Know

Extension Plan Until 2029

In September 2025, the government announced its plan to extend the 0.5% Final Income Tax for MSMEs until 2029. According to the government, this step is intended to provide legal certainty so that businesses are no longer dependent on “year-to-year” extensions.

In a press statement, Coordinating Minister for Economic Affairs Airlangga Hartarto declared:

Regarding the final tax for MSMEs with turnover of IDR 4.8 billion per year, the final tax of 0.5% will be continued until 2029. So, it will not be extended year by year, but certainty is given until 2029.” (Detik Finance, September 15, 2025)

However, no official revision of the regulation has yet been issued. Technical details of the extension remain unclear. Several key questions remain:

- Will the eligibility period be extended (e.g., individuals from 7 years to 12 years)?

- Will the extension apply to all types of MSMEs, or only to individuals?

- Will the annual certificate requirement remain, or will the administration be simplified?

Uncertainty for Corporate MSMEs

The government’s official statement highlighted the extension specifically for individual taxpayers. This raises a major question: what about CVs, cooperatives, firms, and PTs?

If the extension applies only to individuals, thousands of corporate MSMEs will lose access to the 0.5% final rate and be forced into the general corporate income tax regime much sooner. Yet, many MSMEs choose corporate forms to strengthen legality, access financing, and build credibility with business partners.

If the policy only protects sole proprietors, corporate MSMEs may face heavier administrative and fiscal burdens—potentially placing them at a disadvantage compared to individual entrepreneurs who remain covered by the scheme.

Conclusion: Waiting for Certainty, Time to Prepare

The regulatory uncertainty means corporate MSMEs, such as CVs, PTs, and cooperatives, must remain alert. While the extension until 2029 appears aimed clearly at individual taxpayers, the fate of corporate entities remains uncertain pending the issuance of a revised regulation.

In this situation, business owners cannot afford to wait passively. Tax planning, bookkeeping evaluations, and business strategy adjustments must be made early to avoid surprises when the new regulation comes into force.

Contact us to get the right tax and financial advisory support.

References

Government of the Republic of Indonesia. (2018). Peraturan Pemerintah Republik Indonesia Nomor 23 Tahun 2018 tentang Pajak Penghasilan atas Penghasilan dari Usaha yang Diterima atau Diperoleh Wajib Pajak yang Memiliki Peredaran Bruto Tertentu. State Gazette of the Republic of Indonesia Year 2018 No. 91.

Government of the Republic of Indonesia. (2022). Peraturan Pemerintah Republik Indonesia Nomor 55 Tahun 2022 tentang Penyesuaian Pengaturan di Bidang Pajak Penghasilan. State Gazette of the Republic of Indonesia Year 2022 No. 130.

Yanwadhana, E. (2025, September 15). Good news! Final tax policy for MSMEs 0.5% extended until 2029. CNBC Indonesia. https://www.cnbcindonesia.com/news/20250915144004-4-667067/kabar-baik-kebijakan-pph-final-umkm-05-lanjut-sampai-tahun-2029

Hikam, H. A. A. (2025, September 17). Good news! MSME final income tax 0.5% extended until 2029. Detik Finance. https://finance.detik.com/berita-ekonomi-bisnis/d-8115625/kabar-baik-pph-final-umkm-0-5-diperpanjang-sampai-2029