- Phone: (031) 849 5566

- WA: +6282140060234

- Email: [email protected]

- Hours: Mon-Fri, 8am - 5pm

Crypto Asset Taxation in Indonesia: What You Need to Know

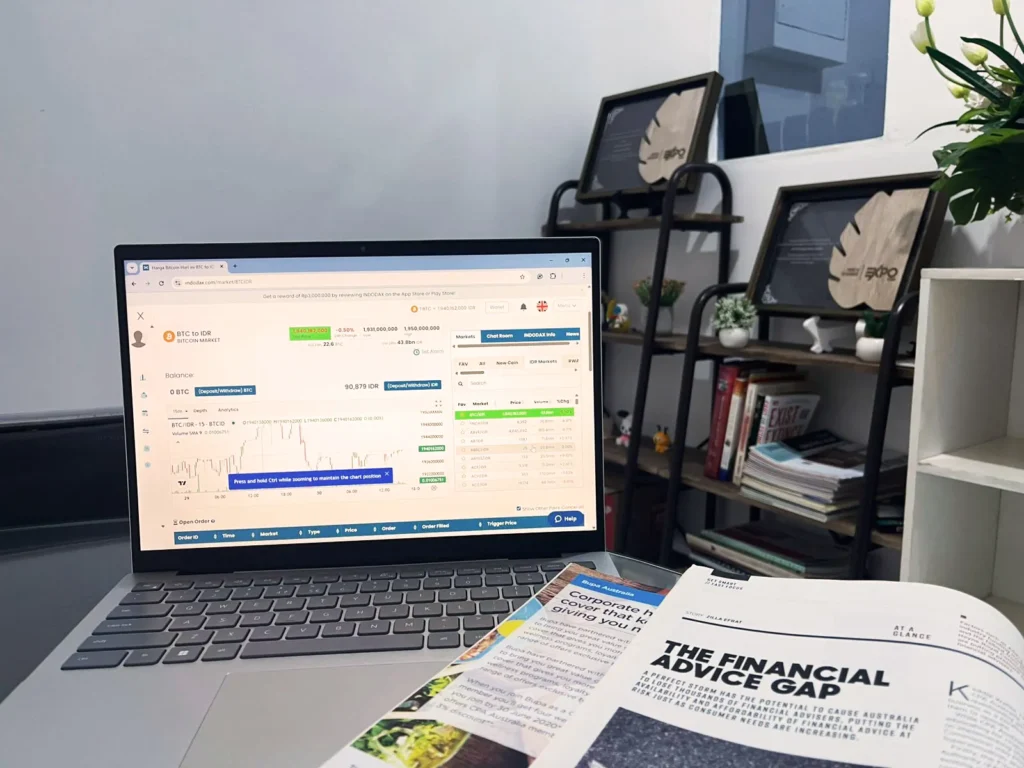

Crypto assets such as Bitcoin, Ethereum, and others have become increasingly popular investment instruments in recent years. Nevertheless, despite their profit potential, many taxpayers in Indonesia remain unaware that these digital assets also carry significant tax implications.

To address this, the Ministry of Finance and the Directorate General of Taxes (DGT) have issued various regulations that establish clear taxation mechanisms for crypto asset transactions—covering both individuals and business entities. In the following sections, you will find a complete explanation.

Legal Basis for Crypto Asset Taxation

Several regulations govern the Indonesia’s taxation of crypto assets, including:

- PMK No. 68/PMK.03/2022 on VAT and Income Tax on Crypto Asset Transactions.

- PMK No. 69/PMK.03/2022 on Tax Treatment for Financial Technology.

- PMK 50/2025 on VAT and Income Tax for Crypto Asset Transactions.

- PER-11/PJ/2022, as the technical implementation guideline.

The government began enforcing these regulations on May 1, 2022, and introduced significant updates effective August 1, 2025, through the issuance of the latest 2025 Minister of Finance Regulation (PMK).

Also Read: 4 New Tax Regulations Effective August 1, 2025: What’s the Impact?

Taxpayer Obligations and Annual Tax Filing (SPT)

Crypto taxes apply not only to individual investors but also to other digital economy participants. For Instance, miners who earn crypto as rewards, developers who receive crypto payments, and service providers paid in crypto are all taxable subjects. Likewise, crypto trading platforms are responsible for collecting, depositing, and reporting both Income Tax and VAT on user transactions.

Furthermore, taxpayers must report all income earned from crypto transactions in their Annual Tax Return (SPT). If the income falls under the Final Income category, they must list it in the final income section. Additionally, taxpayers must also report any crypto assets they hold at the end of the tax year as assets in the Annual Tax Return, including the asset type, acquisition value, acquisition year, and year-end balance. By doing so, they maintain accurate records and ensure proper reporting, which helps them avoid administrative penalties. Accurate recordkeeping and reporting are crucial to avoid administrative penalties.

Also Read: Registered vs. Unregistered Platforms: Why It Matters in Crypto Tax

Types of Taxes on Crypto Assets

a. Crypto Asset Sales

Every crypto trading transaction falls under Final Income Tax Article 22, regardless of whether taxpayers conduct it through domestic or foreign platforms. The tax rate depends on the platform’s domicile. Specifically, when taxpayers trade through a platform domiciled in Indonesia, they pay 0.21% of the gross transaction value. In contrast, if they use a foreign platform, they pay 1% of the gross transaction value. By applying these rules, the government provides both certainty and administrative simplicity in reporting taxes on digital asset transactions. [Legal Basis: Articles 4 to 6 of PMK 50/2025]

Also Read: How Platform Status Impacts Your Crypto Tax Obligations

Crypto swaps—exchanging one crypto asset for another—are treated as two separate transactions. First, disposing of crypto assets is considered income and subject to Final Income Tax. Second, if the swap involves service fees from platforms or PMSEs, such fees are subject to VAT. However, since August 1, 2025, VAT on the crypto asset itself in a swap has been eliminated, so only Final Income Tax applies to the asset relinquished. [Legal Basis: Articles 7 and 10 of PMK 50/2025]

b. Electronic System-Based Trading Services (PMSE)

Effective August 1, 2025, services provided by PMSE operators—such as platform fees, wallet fees, and other tech services—remain subject to standard VAT at 11% on service value, calculated using the alternate value formula: 11/12 × service fee × 12%. On the other hand, the income received by PMSE providers is not subject to Final Income Tax but is considered general income, taxed progressively under Article 17 of the Income Tax Law and must be reported in the Annual Tax Return as income from business or self-employment. [Legal Basis: Articles 7, 10, and 11 of PMK 50/2025]

c. Crypto Mining

Crypto mining activities are classified as business or independent work under Indonesian tax law. Thus, income from block rewards and transaction fees is subject to progressive income tax under Article 17 of the Income Tax Law. Starting August 1, 2025, VAT on the delivery of mined crypto is abolished per Article 14 of PMK 50/2025. However, when the mined crypto is sold through a platform, it is treated as a regular income and subject to Final Income Tax Article 22. [Legal Basis: Articles 13 and 14 of PMK 50/2025]

d. Other Crypto-Related Income

Taxpayers may also receive other types of income from crypto-related activities, such as airdrops, referral bonuses, staking rewards, and profits from Non-Fungible Token (NFT) sales. According to PMK 50/2025, these are not subject to Final Income Tax Article 22 as they do not derive from asset trading. Instead, they fall under general income tax (Article 4 paragraph 1) and must be combined with other income for annual tax calculations, subject to progressive rates. Taxpayers must record and document all receipts to ensure accurate and compliant tax reporting.

| Tax Scheme | Before Aug 1, 2025 (PMK 81/2024) | From Aug 1, 2025 (PMK 50/2025) |

|---|---|---|

| I. Crypto Trading | Final Income Tax (Article 22): • 0.1% (registered platforms) • 0.2% (unregistered platforms) | Final Income Tax (Article 22): • 0.21% (domestic platform) • 1% (foreign platform) |

| VAT on purchase: • 0.11% (registered platforms) • 0.22% (unregistered platforms) | VAT on crypto assets: • Not applicable (treated as securities) | |

| II. Platform Services (PMSE) | • VAT 11% (formula: 11/12 × fee × 12%) • Income Tax under Article 17 | • VAT 11% (formula: 11/12 × fee × 12%) • Progressive Income Tax under Article 17 |

| III. Mining | • VAT 1.1% on crypto delivery • Final Income Tax 0.1% | • VAT eliminated on mining delivery • Progressive Income Tax under Article 17 |

| IV. Foreign Platform Appointment | Foreign platforms designated to collect VAT via PMSE (PMK 60/2022 & PMK 81/2024) | Foreign platforms may be appointed to collect Final Income Tax (Article 22) through a Decree of the DGT, based on administrative and eligibility criteria. |

Practical Issues and Compliance Strategies

Although crypto tax regulations are in place, their implementation still faces challenges. Many taxpayers lack full understanding of their obligations, while the unique characteristics of digital assets create reporting and compliance difficulties. To help navigate this complexity, here are some common challenges and practical tips for staying compliant with current tax rules.

a. Challenges

- Lack of public education on crypto tax regulations.

- High crypto price volatility complicates fair value assessment for reporting.

- Frequent use of unregistered platforms or peer-to-peer systems hampers tax tracking and collection.

b. Tips

- Use officially registered crypto exchanges supervised by Bappebti to ensure lawful and automatic tax deductions.

- Keep all transaction records organized, including buying, selling, transfers, and mining rewards, to support accurate tax reporting.

- Report all income in the Annual Tax Return, even if it hasn’t been converted to fiat currency.

- If needed, consult a tax advisor or professional accountant to ensure your reporting aligns with evolving tax regulations.

Conclusion

Crypto taxation is no longer a gray area under Indonesian tax law. The government has established a clear legal framework to ensure that income from digital assets is taxed fairly and transparently.

For digital asset traders, it’s essential to understand your tax rights and obligations to avoid potential penalties and to contribute to national development through tax compliance. In today’s growing digital economy, tax awareness is a crucial part of smart and responsible investing.