- Phone: (031) 849 5566

- WA: +6282140060234

- Email: [email protected]

- Hours: Mon-Fri, 8am - 5pm

The Impact of Platform Status on Indonesia Crypto Asset Tax Obligations

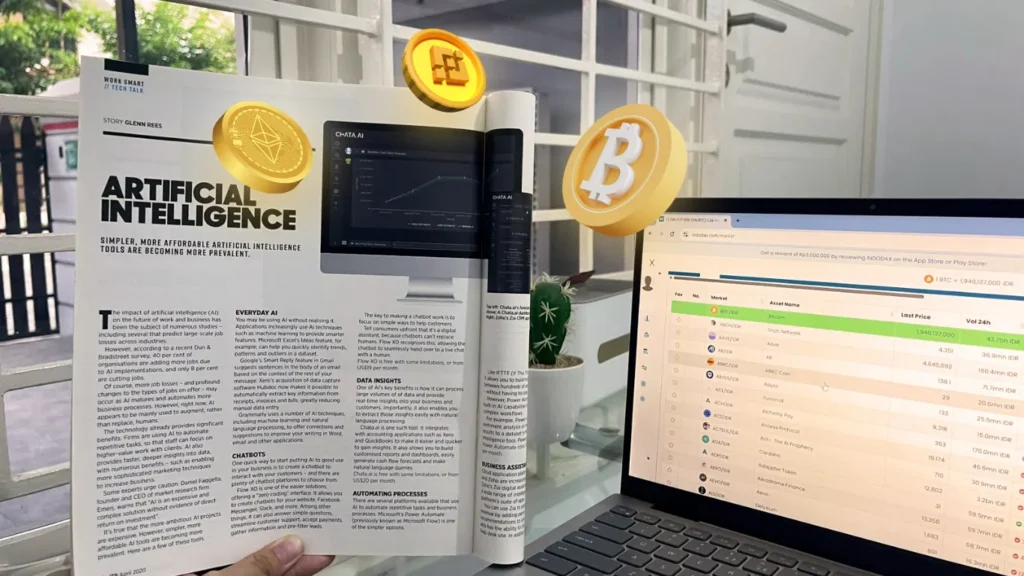

As public interest in crypto assets such as Bitcoin, Ethereum, and various other digital tokens continues to rise, the Indonesian government has established a more structured tax framework through its latest regulations. One of the key aspects in the implementation of taxes on crypto transactions is the status of the platform or exchange where the transaction takes place.

This status directly affects tax rates, withholding obligations, and reporting methods. So, who qualifies as a registered operator? And what are the risks of transacting through unregistered platforms?

What Is a Registered Platform?

Definitions of a registered crypto platform in Indonesia is:

- Officially registered with Bappebti as a licensed crypto asset trader; and

- Appointed by the Directorate General of Taxes (DGT) to withhold final income tax on crypto transactions.

Starting August 1, 2025, with the implementation of PMK 50/2025, the registered status no longer determines whether VAT must be withheld on crypto assets, since VAT on crypto has been eliminated. However, VAT still applies to platform services—such as wallets, swaps, and transaction facilitation.

Registered platforms must withhold, deposit, and report final income tax on behalf of users. By automatically withholding the tax, these platforms simplify the compliance process for users.

Examples of Registered Platforms:

Bappebti’s website provides the list of these registered platforms.

What Is an Unregistered Platform?

An unregistered platform refers to any crypto trading service that does not meet either of the two criteria mentioned above. This includes:

- Foreign platforms (e.g., Binance, OKX, KuCoin, Bybit)

- Peer-to-peer exchanges without a legal entity in Indonesia

- Over-the-counter (OTC) transactions without an intermediary

In these cases, the platform does not withhold taxes automatically. The user is responsible for calculating, paying, and reporting their own tax obligations.

Also Read: Crypto Asset Taxation in Indonesia: What You Need to Know

Tax Implications of Using Different Platforms

The choice of platform for crypto asset transactions has a direct impact on the applicable tax rates. The government now differentiates tax treatment based on the platform’s designation status as a tax collector by the Directorate General of Taxes (DGT), as well as the platform’s jurisdiction—whether domestic or foreign. The applicable tax rates vary depending on the prevailing withholding scheme. Below is a breakdown of the current rates.

| Tax Type | Platform Status | |

|---|---|---|

| Registered | Unregistered | |

| Final Income Tax (Article 22) | 0.1% of transaction value | 0.2% of transaction value |

| VAT on Crypto Transactions | 0.11% of transaction value | 0.22% of transaction value |

| VAT on Platform Services | 11/12 × 12% of service fees (same for both) | |

| Legal Basis: PMK No. 68/PMK.03/2022 | ||

| Tax Type | Platform Status | |

|---|---|---|

| Domestic | Foreign | |

| Final Income Tax (Article 22) | 0.21% of transaction value | 1% of transaction value |

| VAT on Crypto Transactions | Abolished | |

| VAT on Platform Services | 11/12 × 12% of service fees (same for both) | |

| Legal Basis: PMK 50/2025 | ||

Article 20 of PMK 50/2025 emphasizes that income tax paid abroad on income from crypto asset transactions cannot be credited in Indonesia. This is because such income is already subject to final income tax domestically and does not meet the crediting requirements under Article 24 of the Income Tax Law. As a result, taxpayers may face double taxation on the same income.

This tax rate applies to all types of transactions, including buying and selling crypto assets, crypto swaps, and payments for goods or services using crypto. As previously mentioned, when users transact through a registered platform, the platform automatically withholds the tax. In contrast, using an unregistered platform means users must report and pay the tax themselves.

Also Read: 4 Major Tax Changes Coming August 2025 Under PMK 50–53/2025

Conclusion

Choosing where to trade crypto is more than a matter of convenience—it directly affects your tax obligations. Using a registered platform ensures easier compliance, automatic tax withholding, and legal protection. Meanwhile, transacting on unregistered platforms requires users to be proactive in fulfilling their own tax responsibilities. Therefore, staying compliant is a legal duty and a protection from future risks. Contact us for further consultation or tax support.