- Phone: (031) 849 5566

- WA: +6282140060234

- Email: [email protected]

- Hours: Mon-Fri, 8am - 5pm

Accounting Profession: Who They Are and What They Do

Why the Accounting Profession Remains Relevant in the Digital Era

In today’s digital era, the accounting profession continues to play a crucial role in the business world. While many tasks can now be automated through software, companies still need accountants who understand financial data and can provide sound advice. Accountants are like financial navigators, helping businesses stay on the right course.

What Is the Accounting Profession?

The accounting profession involves the recording, management, analysis, and reporting of financial data. But don’t be mistaken—accountants don’t just count money, record transactions, or create financial statements.

They also play a vital role in maintaining a company’s financial integrity, ensuring compliance with regulations, and offering strategic advice to management.

Types of Accountants in Indonesia

1. Public Accountants

These professionals work independently, often under a Public Accounting Firm (KAP). Their duties include auditing financial statements and providing financial consulting services for clients across various industries. Their main services include:

- Taxation

- Accounting system development

- Financial statement audit

- Management consulting

- Financial reporting for credit application purposes

2. Internal Accountants

As the name implies, internal accountants work directly within a company. They may hold positions ranging from accounting staff to department head or even Chief Financial Officer. Their responsibilities include:

- Assisting management with financial planning

- Analyzing reports

- Developing internal accounting systems

- Preparing internal and external reports

- Ensuring efficient resource management

- Budgeting

- Handling tax matters

3. Government Accountants

Government accountants ensure the country’s financial activities are conducted properly and effectively. They usually work in institutions such as the Audit Board of Indonesia (BPK) and the Financial and Development Supervisory Agency (BPKP).

4. Academic Accountants

Education is the focus of this type of accountant. They train and develop future accountants through:

- Teaching accounting theories, practices, and sharing real-world experiences

- Conducting research and advancing the field of accounting

- Designing accounting education curriculums

5. Tax Accountants

These accountants focus on tax documentation and reporting. They calculate, fill out, and submit annual tax returns for both businesses and individuals to the Directorate General of Taxes (DJP). In short, tax accountants ensure that all tax obligations are fulfilled in accordance with the law.

6. Management Accountants

These professionals must possess strong analytical skills, effective communication abilities, and excellent problem-solving capabilities. Their focus is on supporting management decision-making by:

- Providing relevant accounting and financial information

- Preparing budgets and financial reports

- Monitoring company expenditures

Each type of accountant plays a specific role in the financial and business world. Whether in private companies, government institutions, or educational settings, accountants help ensure accuracy, regulatory compliance, and informed decision-making.

Amid these complexities, many businesses rely on professional Accounting Services Firms (also known as Kantor Jasa Akuntan or KJA in Indonesian) to manage their accounting needs efficiently and reliably. One such trusted partner is PT Synergy Ultima Nobilus, offering a consultative approach and an experienced team to help businesses grow on a stronger financial foundation.

Key Responsibilities in the Accounting Profession

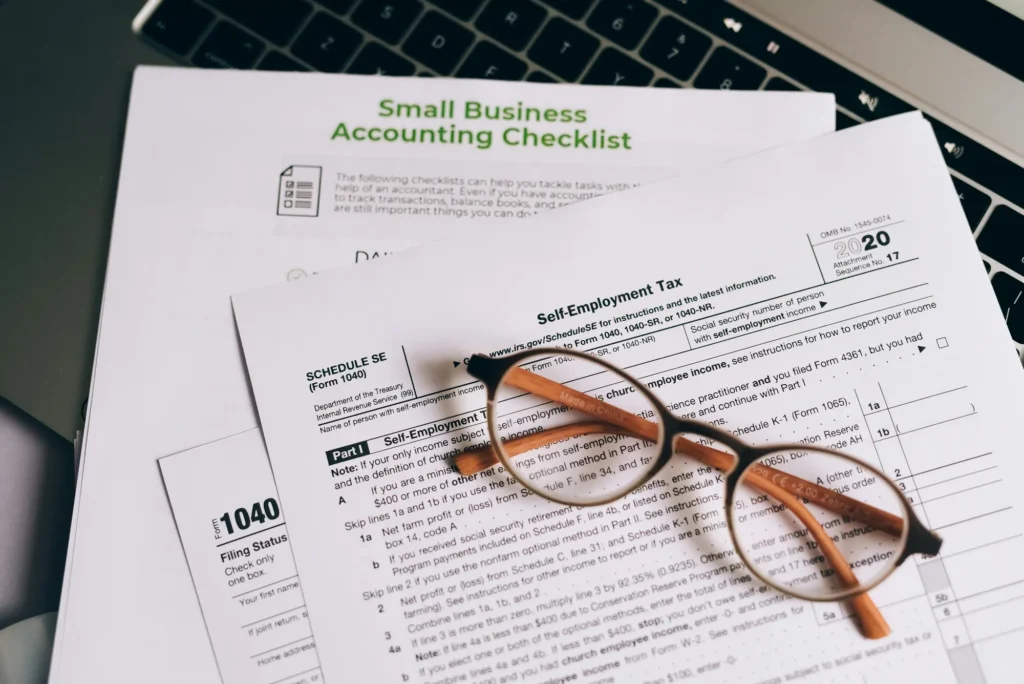

Preparing Financial Statements

All accountants—whether public, internal, or otherwise—are responsible for compiling and presenting accurate financial statements in compliance with applicable standards.Providing Financial and Strategic Advice

Accountants advise businesses on financial management, tax strategies, and critical decisions affecting the company’s financial stability and growth.Managing and Analyzing Financial Data

They manage, analyze, and monitor financial data, including monthly, annual, or ad-hoc reports to support strategic decision-making.Organizing Bookkeeping and Financial Records

Accountants maintain detailed and systematic records of financial transactions, ensuring compliance and facilitating future financial planning.Ensuring Tax Compliance

While tax accountants specialize in taxation, all accountants help ensure that companies meet their tax obligations properly and on time.

Career Opportunities for Accountants Across Industries

Accounting is a highly flexible career path. You can work in large corporations, startups, financial institutions, hospitals, or even nonprofit organizations. Every sector needs accurate and well-managed financial records—this is where accountants are essential.

In reputable firms like PT Synergy Ultima Nobilus, young professionals have the opportunity to grow—not just through work experience, but also by learning directly from experts in accounting and finance.

Learn more here: Synergy Career

Qualifications Required to Become a Professional Accountant

Becoming a professional accountant requires more than just the ability to crunch numbers. It demands a combination of academic background, formal certifications, and interpersonal skills. Key qualifications include:

1. Relevant Educational Background

At minimum, a professional accountant should hold a Bachelor’s degree in Accounting. For strategic or specialized positions, a Master’s degree in Accounting or Financial Management is often preferred. Certified courses and training programs also provide a significant edge.

2. Recognized Professional Certifications in Accounting & Finance

Certifications indicate that an accountant meets global standards of competence. Common certifications include:

- CPA (Certified Public Accountant)

- CA (Chartered Accountant)

- ACCA (Association of Chartered Certified Accountants)

For specialization, there are additional certifications such as:

- CPMA (Certified Professional Management Accountant) – for management accounting

- CFA (Chartered Financial Analyst) – for finance and investment analysis

- SAS (Sharia Accounting Certificate) – for Islamic finance professionals

These certifications enhance credibility and open doors to both domestic and international opportunities.

3. Technical and Soft Skills

Today’s accountants are expected to:

- Think critically and analytically to solve financial problems

- Master modern accounting software and tools (e.g., ERP systems, advanced Excel, cloud-based tools)

- Communicate effectively in both written and verbal formats

- Collaborate across departments and interact professionally with clients

Balancing technical proficiency with interpersonal capabilities is key to becoming a reliable and trustworthy accountant.

The Importance of the Accounting Profession in Business

In a time of economic uncertainty, accountants remain essential as financial advisors. No matter the situation, companies need transparent financial reports, sound strategic advice, and solid internal controls. Businesses need professionals who can interpret data, manage risk, and guide financial decisions. Accountants will always be relevant because they serve as both strategic advisors and financial controllers.

Conclusion

The accounting profession is not just about numbers—it’s about precision, trust, and impactful decision-making. In a complex and fast-paced business world, accountants serve as steady guides and reliable partners. They help ensure that operations remain compliant and aligned with organizational goals.

If your business is looking for a trusted partner to handle financial reports, audits, or strategic consulting, PT Synergy Ultima Nobilus is ready to assist. With proven experience and integrity, we help companies of all sizes achieve healthier, more focused financial management.

Want to know more about our services? Click here.