- Phone: (031) 849 5566

- WA: +6282140060234

- Email: [email protected]

- Hours: Mon-Fri, 8am - 5pm

MSME Tax: 7 Rules Every Business Owner Must Know

Tax compliance is often not a top priority for many small business owners, even though it plays a critical role in business sustainability. Understanding MSME (Micro, Small, Medium Enterprises) tax rules from the start helps ensure your business operates legally and smoothly, supporting your journey toward long-term success.

Especially starting in 2025, there are major changes to MSME tax regulations you need to know, particularly regarding the 0.5% Final Income Tax scheme that has a time limit. This article covers the latest updates to help you stay compliant and continue growing.

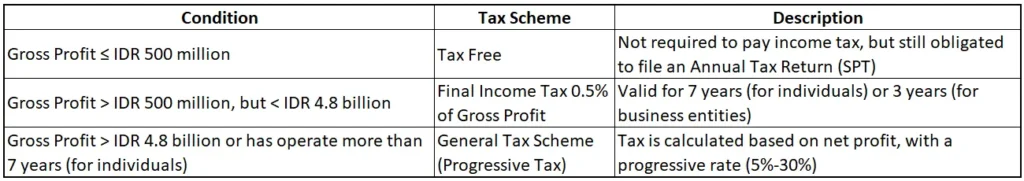

1. MSME Tax-Free Revenue Threshold

One benefit offered by the government is income tax (PPh) exemption for annual revenues up to IDR 500 million. If your yearly turnover is below this threshold, you’re not required to pay income tax.

However, you are still obligated to file an Annual Tax Return (SPT) every year. This policy supports the growth of micro and small enterprises that are registered as individual taxpayers.

2. Understanding the 0.5% Final MSME Tax Scheme

If your annual revenue exceeds IDR 500 million, a 0.5% final income tax applies. But there are a few important conditions:

- This 0.5% scheme applies for 7 years for individual taxpayers, 4 years for CVs, and 3 years for legal entities.

- After the time limit or if revenue exceeds IDR 4.8 billion, you must switch to the regular tax scheme based on net income.

3. Importance of Having a Tax ID (TIN)

Every MSME must have a Tax Identification Number (TIN) to be officially registered with the Directorate General of Taxes (DGT / DJP). It serves as your tax identity and is required to:

- Pay MSME taxes

- Participate in government project tenders

- Apply for business loans

TIN registration is now easier and fully online via the DJP Coretax platform. Make sure to integrate your Indonesian Resident Number (NIK) with TIN to avoid reporting or payment issues.

4. Filing Annual Tax Returns for MSMEs

All MSMEs are required to submit an Annual Tax Return (SPT) before the end of March each year. Failure to do so may result in penalties or administrative sanctions.

Tax reporting is now done through DJP Coretax at https://coretaxdjp.pajak.go.id, a more integrated platform that simplifies online filing. Report your total business income from the previous fiscal year accurately.

If you need help understanding your tax obligations, the Synergy Ultima Nobilus team offers professional tax services specifically for MSMEs, ensuring you stay compliant with ease.

5. Digital MSMEs and Their Tax Obligations

Many MSMEs operate through marketplaces or social media platforms like Shopee, Tokopedia, TikTok Shop, or Instagram. Note that digital MSMEs are also subject to taxes.

While some platforms may automatically deduct VAT, you are still responsible for reporting and paying your own Final Income Tax. If your business operates on multiple platforms, total your gross revenue across all of them.

6. Separate Finances to Simplify MSME Tax Reporting

One of the most common mistakes MSMEs make is mixing personal and business finances. This can create issues when calculating taxes.

Why should you separate them?

- Easier tracking of revenue and expenses

- More accurate financial reports

- Smoother SPT preparation

- Better loan or investor opportunities

Start by opening a dedicated business bank account. Use simple bookkeeping tools or spreadsheets to track your finances. Organized finances make tax reporting much easier.

Read Also: 5 Reasons Business Taxes Are Crucial to Your Company’s Success

7. MSME Tax Incentives and Penalty Waivers

The government occasionally offers tax relaxation programs or penalty waivers for MSMEs, especially post-pandemic or during economic crises. These programs can help businesses catch up on compliance without facing huge penalties.

Stay informed by checking the official DJP website, their social media channels, or by consulting with a tax advisor. Don’t miss these valuable opportunities.

Conclusion: Compliant MSMEs Are More Competitive

Understanding and complying with MSME tax regulations isn’t just a legal obligation—it’s a smart business investment. A tax-compliant business can:

- Easily access funding

- Earn greater trust from partners

- Be better prepared for expansion

If you need assistance managing your tax obligations, Synergy Ultima Nobilus is ready to support you.

For personalized consultation or more information, feel free to contact us. A compliant MSME is one step closer to scaling up.

Want to know more? Check out our services.