- Phone: (031) 849 5566

- WA: +6282140060234

- Email: [email protected]

- Hours: Mon-Fri, 8am - 5pm

Tax Audit Efficiencies Based on PMK 15/2025

Tax audit is an essential process for ensuring taxpayers’ compliance. Through these audits, the Directorate General of Taxes (DGT) verifies the fulfillment of tax obligations, including the accuracy of tax reporting and payment.

Starting in February 2025, the Government of Indonesia introduced new provisions under Regulation of the Minister of Finance Number 15 of 2025 on Procedures for Tax Audit. This regulation replaces several previous rules (PMK 17/2013 and PMK 256/2014) governing audit procedures. Below are the main points that business actors need to note:

Purposes of Tax Audit

The audit framework is now classified into two main objectives:

- Testing Compliance – to ensure that tax obligations are fulfilled properly.

- Other Purposes – including law enforcement or compliance with tax legislation.

Based on these objectives, Article 4 of PMK 15/2025 establishes 14 criteria for audits aimed at testing compliance and 25 criteria for audits conducted for other purposes.

Scope and Duration of Tax Audit

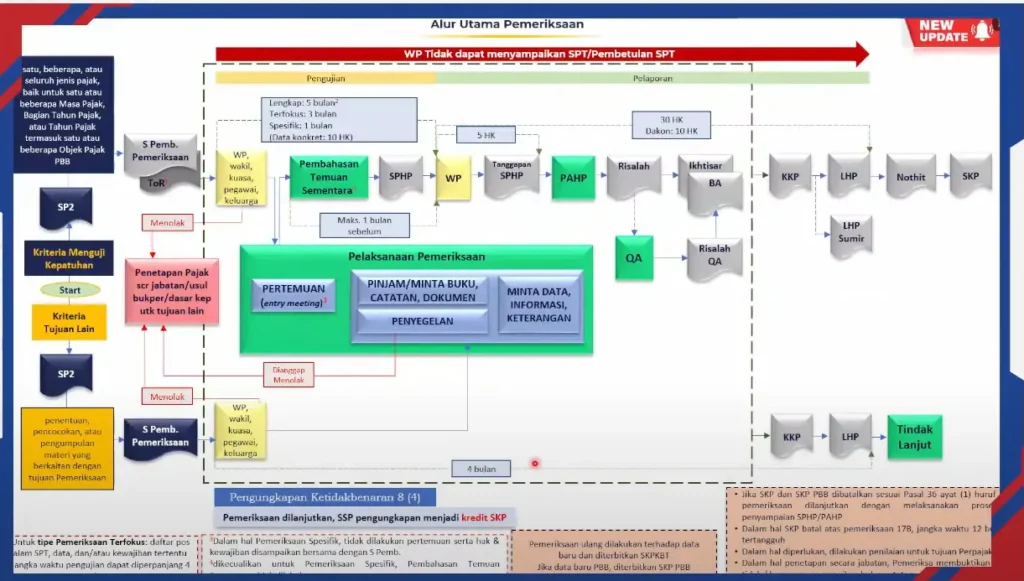

The tax audit conducted for test compliance is divided into three types:

- Comprehensive Audit

This covers all elements of the Tax Return (SPT) or Tax Object Notification Letter (SPOP), including examination of all reported taxes. Tax authorities typically conduct this type of audit when there are large restitution claims, fiscal loss reports, or significant data discrepancies. - Focused Audit

This audit limits the scope to certain items in the SPT or SPOP. For instance, reviewing specific transactions with a potential underpayment risk. - Specific Audit

This applies only to certain conditions, such as affiliated transactions, large-scale asset transfers, or other high-risk transactions.

Below is a summary of the timeframes for each type of audit:

| Type of Audit | Scope | Technique | Maximum Duration | |

|---|---|---|---|---|

| Examination | Reporting | |||

| Comprehensive | All items in SPT / SPOP | In-depth | 5 months | 30 days |

| Focused | One or several specific items | In-depth | 3 months | |

| Specific | One or several specific items | Simple | 1 month | |

| ** Special Conditions ** | ||||

| Execution Based on Concrete Data | Specific items based on valid data already held by DGT | Simple | 10 days | 10 days |

| Group taxpayers, indications of transfer pricing, or complex transactions | According to audit type | According to audit type | Audit duration + extension of 4 months | 30 days |

The tax audit conducted for other purposes is generally administrative and does not always involve a comprehensive review of all tax obligations. Therefore, Article 6 of PMK 15/2025 stipulates a maximum total period of 4 months from the issuance of the Audit Notification Letter (SP2) until the final audit report is completed.

Taxpayer Obligations to Submit Data

Article 12 paragraph (4) of PMK 15/2025 requires taxpayers to provide all data requested by tax auditors within a maximum of 1 month. Tax authorities have the right to treat any documents you submit after the deadline as if you never submitted them.

Article 18 paragraph (2) of PMK 15/2025 also shortens the deadline for taxpayers to submit responses to the Audit Findings Notification (SPHP) to 5 working days. The government introduced this to expedite the completion of the audit process and improve the efficiency of the objection mechanism against audit results.

Tax auditors must prepare Minutes of Audit (BA) at the end of the process to record whether the taxpayer has fulfilled their obligation to submit the requested documents.

Auditor Determinations

If there are indications of a tax crime, the auditor may recommend initiating a Preliminary Evidence Examination (Bukper) as the first step in handling the suspected violation.

In audits where there is an indication that the taxpayer’s annual turnover exceeds IDR 4.8 billion, the auditor is authorized to assign the status of VATable Entrepreneur (Pengusaha Kena Pajak/PKP) ex officio if the taxpayer fails to provide complete information or otherwise obstructs the examination process.

Read also: KJA: Reliable Partner for Financial Statements and Tax Compliance

Don’t let negligence put your business at risk

If you would like to discuss your company’s readiness to face a tax audit, PT Synergy Ultima Nobilus can help you through every stage of the process—from document preparation and internal reviews to assistance during discussions with tax auditors.

Contact us for further consultation.

References

Regulation of the Minister of Finance of the Republic of Indonesia Number 15 of 2025 on Tax Audits (PMK 15/2025)

Indonesian Institute of Accountants. RTD – In-Depth Discussion on Tax Audits in the Coretax Era under PMK No. 15 of 2025. Webinar, July 3, 2025. YouTube Link.